Wayne Lumbasi

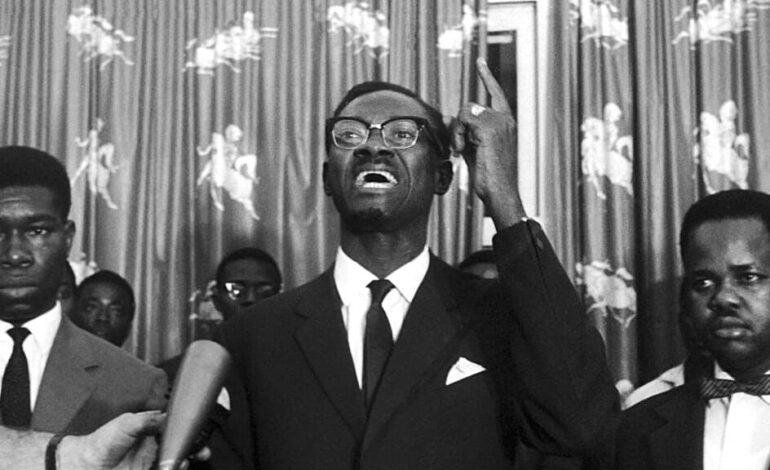

The Democratic Republic of Congo has opened a selection of strategic mineral assets to United States investors under a bilateral minerals pact aimed at expanding cooperation in the development of resources critical to global energy, technology and industrial supply chains.

The assets include projects linked to manganese, copper-cobalt and lithium, minerals that are central to electric vehicle battery production, renewable energy storage, advanced electronics and defence manufacturing. Congo dominates global cobalt production and is Africa’s largest copper producer, placing the country at the centre of the global transition toward clean energy and high-tech manufacturing.

The assets have been drawn from state-owned mining companies and are limited to projects that are not tied to existing joint ventures or commercial agreements. This approach allows new investors to engage on clear terms and reflects Congo’s broader effort to widen foreign participation in a mining sector that has long been shaped by Chinese investment.

Among the proposed assets are copper-cobalt projects held by Gecamines, including the Mutoshi site, alongside a germanium processing venture. Germanium is classified as a strategic mineral due to its use in semiconductors, fibre-optic systems and advanced defence technology. Lithium licences have been submitted by Cominiere, highlighting Congo’s ambition to position itself as a future supplier of a metal that is seeing rapidly rising global demand. Additional offerings include manganese, gold and cassiterite licences from Kisenge, gold permits controlled by Sokimo, and coltan and wolframite assets overseen by Sakima.

Congo is estimated to hold about 70% of global cobalt reserves, alongside vast copper deposits concentrated in its southern mining belt and growing lithium discoveries. Mining generates more than 30% of state revenue and accounts for over 90% of export earnings, underlining the sector’s importance to the national economy.

Implementation of the minerals pact is being coordinated through a joint steering committee bringing together authorities responsible for economic policy, mining oversight, finance and foreign affairs, as well as the national minerals regulator. The body is expected to guide investor engagement, assess project readiness and advance discussions toward commercial agreements.

The initiative aligns with Congo’s objective of moving beyond the export of raw materials by encouraging investment in processing, refining and local value addition. The aim is to strengthen domestic capacity, increase employment and capture a greater share of the value generated from mineral resources.

RELATED: