Wayne Lumbasi

China’s financial engagement with Africa has entered a decisive new phase, marking a clear departure from the period when large scale lending helped finance infrastructure and public investment across the continent. Once a major source of development capital, China is now receiving more in debt repayments from African countries than it is providing in new loans, reflecting a profound shift in financial flows and policy direction.

Research tracking international financing shows Africa moved from $30.4 billion in net inflows from China between 2010 and 2014 to $22.1 billion in net outflows in the most recent five year period. This represents a swing of more than $52 billion in just over a decade and confirms that repayments now outweigh fresh lending across a growing number of African economies.

During the earlier phase, Chinese financing played a central role in closing Africa’s infrastructure gap. Loans supported the construction of roads, railways, ports, power plants, and industrial facilities that were critical to economic expansion. Many of these loans were structured with extended grace periods, allowing governments time to complete projects before repayment obligations began. That repayment phase has now arrived for many borrowers.

At the same time, the volume of new Chinese lending has declined sharply. Annual loan commitments that once reached tens of billions of dollars have fallen to a small fraction of previous levels. Financing has become more selective, with fewer large projects approved and tighter risk assessments applied to countries facing high debt burdens. As a result, incoming funds are no longer sufficient to offset rising repayment demands.

The combined effect of higher debt servicing and lower new lending has tightened public finances across the continent. Governments are devoting a larger share of national revenue to external debt payments at a time when economic growth remains uneven and fiscal pressures are mounting. In several African countries, repayments to China now consume resources that could otherwise be directed toward healthcare, education, infrastructure maintenance, or social support programs.

This shift has also reshaped the broader development finance landscape. As Chinese lending has slowed, multilateral institutions such as the World Bank and the African Development Bank have expanded their role and now account for a larger share of net external financing flowing into Africa. While this has helped stabilize funding for some economies, it has also increased reliance on financing that comes with policy conditions and fiscal reform requirements.

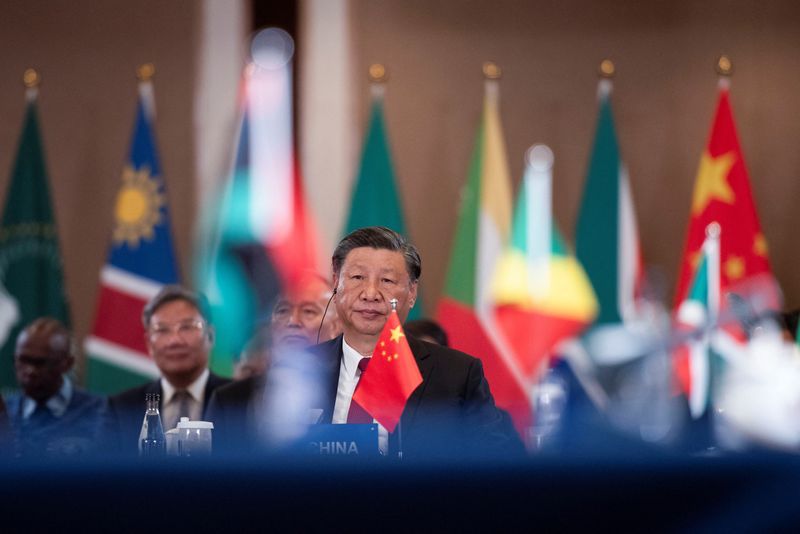

China’s evolving approach does not signal a withdrawal from Africa but rather a recalibration of engagement. Economic ties are increasingly centered on trade, direct investment, and targeted development projects rather than broad loan financed infrastructure expansion. This change reflects a more cautious lending strategy and a focus on long term financial sustainability.

For African governments, the shift from net recipient to net payer highlights a critical challenge. Managing repayment obligations accumulated during a period of abundant external credit while sustaining economic growth and development has become increasingly complex. As global financial conditions tighten and access to large scale bilateral lending diminishes, the emphasis is shifting toward stronger debt management, improved revenue mobilization, and more diversified sources of finance.

Ultimately, China’s changing financial role highlights a broader reality confronting African economies. The era of easy external financing is fading, and future development will depend more heavily on fiscal discipline, strategic investment choices, and sustainable financing models that balance growth ambitions with long term stability.

RELATED: