Faith Nyasuguta

Zimbabwe’s state-owned Kuvimba Mining House is gearing up to break ground on a landmark $270 million lithium concentrator at its Sandawana mine, marking another big step in Africa’s push to add value to its raw minerals instead of simply exporting them.

Kuvimba CEO Trevor Barnard confirmed that construction will start in the third quarter of 2025, with the plant expected to be fully operational by early 2027. The project will process 600,000 metric tons of lithium ore every year, making it one of Zimbabwe’s largest value-addition undertakings to date.

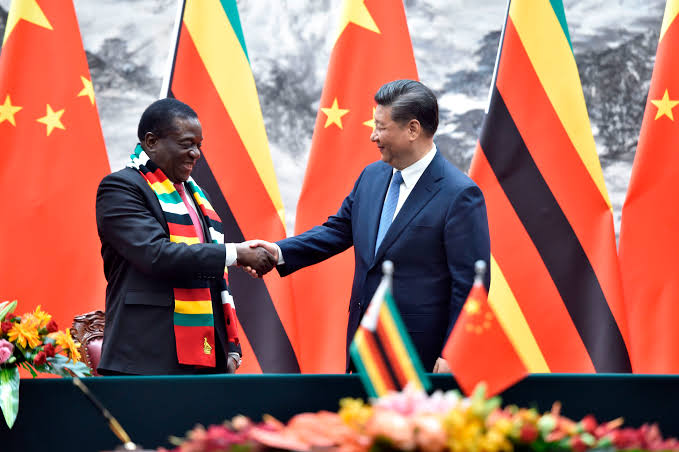

What makes this project stand out is Zimbabwe’s close partnership with two major Chinese metals companies – though Barnard says their names can’t be disclosed yet due to ongoing negotiations. Under the deal, the Chinese firms will build and operate the plant for five years before transferring full ownership and management to Kuvimba.

“We’re finalising the last legal and technical agreements to make sure we’re aligned with industry standards,” Barnard told reporters. “If all goes well, we’re looking at breaking ground before the end of September.”

The timing could be crucial for Zimbabwe’s mining ambitions. While lithium spot prices have plunged nearly 90% in recent months due to oversupply and a slowdown in electric vehicle (EV) demand, analysts believe the slump won’t last.

According to Barnard, the commissioning of the Sandawana plant in 2027 could coincide with a rebound in global lithium prices. “We expect supply and demand to balance out as EV sales recover, which would support our revenues when production kicks off,” he said.

Data from CRU Group shows that Zimbabwe already accounts for about 14% of China’s lithium imports, making it a strategic supplier for Chinese battery and EV manufacturers. Chinese companies are eager to lock in reliable feedstock to keep their domestic refineries running, despite current price pressures.

Meanwhile, Zimbabwe’s government is making it clear that it wants more of the lithium value chain to stay local. Last month, the country announced that it will ban the export of lithium concentrates starting January 2027, just as Kuvimba’s new plant goes online.

This bold policy shift aims to stop the flow of unprocessed lithium ore to China and other countries for refining. Instead, Zimbabwe wants to position itself as a hub for battery-grade lithium production.

Beyond Sandawana, two new lithium sulphate processing plants are under development – one at Bikita Minerals, owned by China’s Sinomine Resource Group, and another at Prospect Lithium Zimbabwe, operated by Zhejiang Huayou Cobalt.

The rush for Africa’s lithium is gathering pace in other countries too, with Namibia, Mali, Ghana, and the Democratic Republic of Congo all scaling up exploration and mining to stake a claim in the fast-growing battery minerals market.

For Zimbabwe, the Sandawana plant is more than just a mine – it’s a signal that the country intends to turn its natural resources into real industrial growth.

RELATED: