Wayne Lumbasi

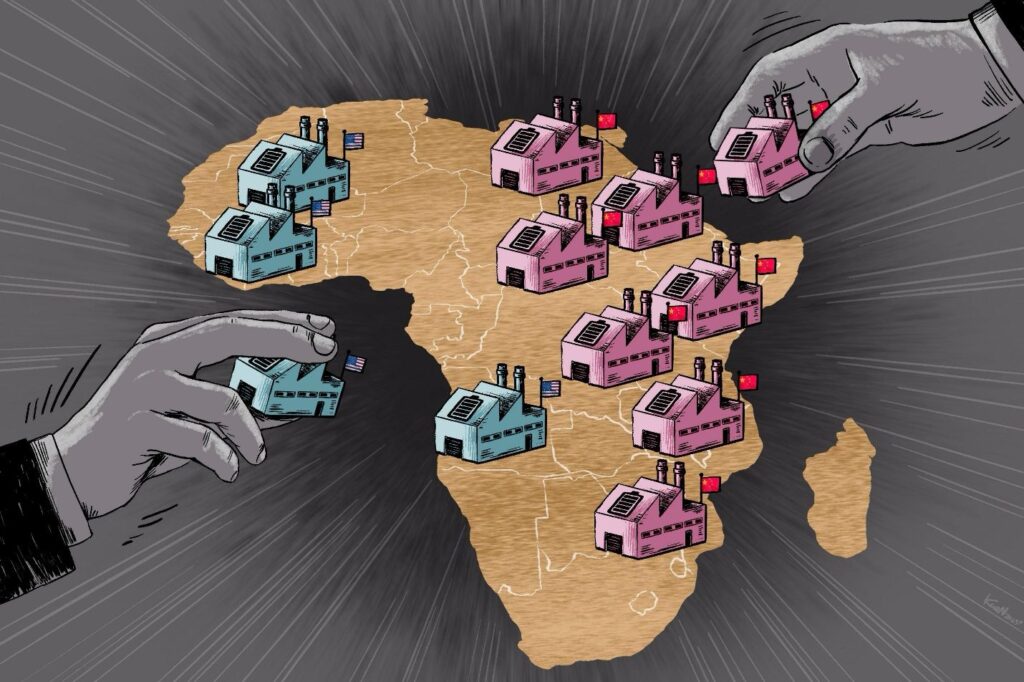

The United States is intensifying efforts to counter China’s long established dominance over Africa’s vast mineral resources, as competition sharpens for materials critical to global energy transition, advanced manufacturing and security industries.

Africa is home to some of the world’s richest deposits of cobalt, copper, lithium, manganese and rare earth minerals. These resources are essential for electric vehicles, renewable energy systems, electronics and defense equipment. China has spent decades securing access to these minerals through heavy investment in mining operations, transport infrastructure and processing facilities across the continent, giving it a commanding position in global supply chains.

In response, the United States is adopting a different strategy aimed at securing long term access without direct control of mining assets. Rather than owning mines, it is supporting arrangements that guarantee future mineral supply through purchasing agreements and financing structures. In countries such as the Democratic Republic of Congo and Zambia, these deals focus on cobalt and copper production, minerals that are central to battery manufacturing and power transmission.

This approach contrasts sharply with China’s model, which relies heavily on state backed companies that own and operate major mining projects. Chinese firms control significant portions of mineral production in the Democratic Republic of Congo, the world’s largest source of cobalt, and dominate the processing stage that converts raw materials into usable industrial inputs. Control over processing has allowed China to exert influence far beyond the mine itself.

The United States is also seeking to reduce dependence on Chinese processing capacity by encouraging refining and manufacturing to take place elsewhere. Financial incentives and long term supply guarantees are being used to attract companies to process African minerals in the United States or in partner countries. This effort targets a critical bottleneck in the global minerals supply chain, where China currently holds a strong advantage.

Governance and transparency are central to the US approach. Projects supported through American backed financing often emphasize environmental standards, labor protections and clearer revenue arrangements with host countries. These measures are intended to promote sustainable investment and reduce long term risks for both investors and resource producing nations.

Despite the renewed push, China retains a substantial lead. Its early entry into African mining, combined with large scale financing and infrastructure development, has entrenched its position across many mineral rich regions. Chinese companies continue to control key assets and processing facilities, making it difficult for competitors to displace them quickly.

For African countries, growing competition between global powers is creating new leverage. Governments are increasingly seeking better commercial terms, commitments to local value addition and expanded employment opportunities. At the same time, balancing foreign interests while protecting national priorities remains a complex challenge.

As demand for critical minerals continues to rise, competition in Africa is expected to intensify further. The outcome will shape future supply chains for clean energy and advanced technologies, while also influencing Africa’s economic role in a rapidly evolving global landscape.

RELATED: