Wayne Lumbasi

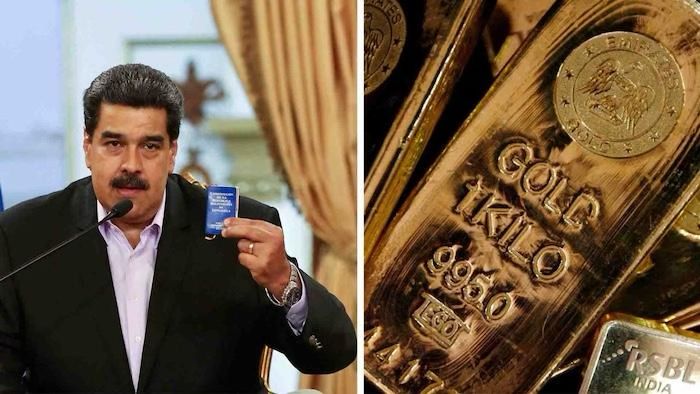

Venezuela shipped 113 metric tonnes of gold from its central bank to Switzerland between 2013 and 2016, a move that generated around 4.14 billion Swiss francs (approximately $5.20 billion) as the country grappled with a deepening economic crisis under President Nicolas Maduro.

The shipments, revealed through Swiss customs data, took place shortly after Maduro assumed office and coincided with falling oil revenues, rising inflation and mounting pressure on foreign currency reserves. At the time, Venezuela relied heavily on gold sales to obtain hard currency needed to stabilize the economy and meet external obligations.

Switzerland, home to some of the world’s largest gold refineries, is a key global hub for refining and trading the precious metal. While the exact destination and end-buyers of the Venezuelan gold remain unclear, the shipments are believed to have entered international markets after being refined or used in financial transactions.

Gold exports from Venezuela to Switzerland came to a halt in 2017, the same year the European Union imposed sanctions on Venezuelan officials over human rights concerns and democratic backsliding. Switzerland later aligned with those measures in 2018. Although the sanctions did not explicitly ban Venezuelan gold imports, no further shipments have been recorded since then, raising questions about both sanctions pressure and the depletion of Venezuela’s reserves.

The issue has resurfaced following a recent move by Swiss authorities to freeze assets linked to Nicolas Maduro and 36 of his associates. The Swiss government said the decision was taken to prevent the potential transfer or concealment of assets that could be subject to future legal proceedings. The total value and nature of the frozen assets have not been disclosed.

Swiss officials have stressed that the asset freeze is precautionary and does not automatically imply wrongdoing. They also said the measure is separate from the earlier gold shipments and targets individuals rather than the Venezuelan state.

As Venezuela’s economic situation worsened and sanctions tightened, the government under Nicolas Maduro began selling off its gold reserves to raise hard currency, leading to a major legal conflict over a significant portion of gold stored in the Bank of England, World Bank.

There has been no official confirmation that proceeds from the gold sales remain in Switzerland or are directly connected to the frozen assets. However, the development highlights the continued international scrutiny surrounding Venezuela’s overseas wealth and the financial legacy of years of economic turmoil.

The gold shipments and the latest asset freeze add to a broader pattern of disputes involving Venezuelan assets abroad, showcasing how the country’s financial crisis has evolved into a prolonged international legal and diplomatic challenge.

RELATED: