Faith Nyasuguta

Botswana, Africa’s largest diamond producer and long considered one of the continent’s most stable economies, is staring down a fresh economic storm that could force it to devalue its currency again before the year ends. Citigroup Inc. has sounded the alarm, warning that Botswana’s pula – already one of Africa’s weakest-performing currencies this year – may need to weaken further as the country’s diamond revenues continue to nosedive.

Rough diamond sales, the lifeline of Botswana’s economy, have slumped dramatically due to a global market flooded with cheaper lab-grown alternatives. In the first half of 2024 alone, sales plunged by nearly 50%, and production cuts have followed suit. Debswana, the country’s biggest diamond producer, has trimmed output by more than a quarter and signaled that more cuts may be unavoidable if prices stay depressed.

This downturn could not have come at a worse time. Diamonds account for almost a third of Botswana’s government revenue and around 75% of its foreign exchange inflows. The sudden drop has left a gaping hole in the country’s coffers and put heavy pressure on its foreign reserves, which have historically been strong enough to cover over ten months of imports. Now, those reserves have slipped to barely five months’ worth – an all-time low.

To cope, the Bank of Botswana has already adjusted its exchange rate policy, widening the allowable depreciation band for the pula from 1.51% to 2.76% this year. Even with that, the currency has weakened more than 3% against the US dollar since January, ranking among the continent’s five worst performers.

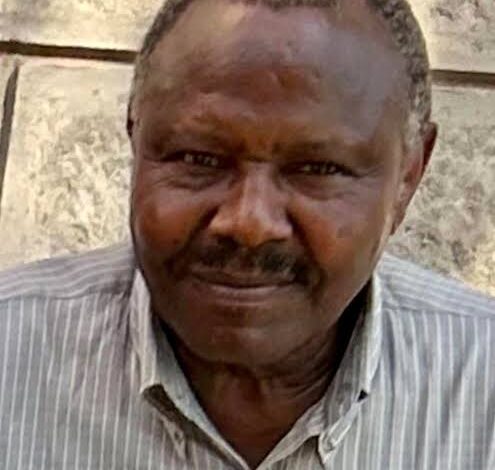

Yet for many economists, this may not be enough. Citigroup’s Chief Africa Economist, David Cowan, believes another devaluation is likely if diamond demand does not rebound soon.

The government is scrambling to cushion the blow. Austerity measures have been rolled out, including cuts to official travel budgets, restrictions on vehicle purchases for government use, and the postponement of some capital projects. The central bank has also held the country’s benchmark interest rate steady at 1.9% since August last year, but further currency pressure could force a rate hike – raising borrowing costs for businesses and households alike.

While letting the pula weaken might help Botswana’s diamond exports fetch more in local currency terms and boost the competitiveness of other sectors like tourism and beef, it comes with risks. A weaker currency makes imports – everything from fuel to food – more expensive, stoking inflation in a country already reliant on imported goods.

Botswana’s strong fiscal discipline and historically healthy reserves have helped it weather storms before, but the scale of this diamond crisis is unlike any the country has faced in decades. With reserves dwindling, growth forecasts slashed, and diamond revenues in free fall, Botswana’s leaders now face an uneasy balancing act: use devaluation to prop up exports, or hold the line to avoid runaway inflation and a possible currency crisis.

What is clear is that for a country whose fortunes have long been tied to the glittering promise of diamonds, the sparkle is fading – forcing Botswana to rethink how it protects its economic crown jewel.

RELATED: