Wayne Lumbasi

For many African and Caribbean nations, the weight of foreign debt has become a defining challenge of the twenty first century. Despite vast natural resources, cultural wealth, and human potential, these regions continue to struggle under the pressure of loans owed to international lenders such as the International Monetary Fund (IMF), the World Bank, and private creditors.

What began as efforts to stimulate growth and development has, over time, evolved into a cycle of borrowing and repayment that often deepens poverty instead of reducing it.

One of the most serious impacts of large foreign debts is the strain they place on national budgets. Many these governments spend more on debt repayment than on essential services such as education, health care, and infrastructure. The constant need to service interest payments drains public resources that could have been used to build schools, hospitals, and transport systems.

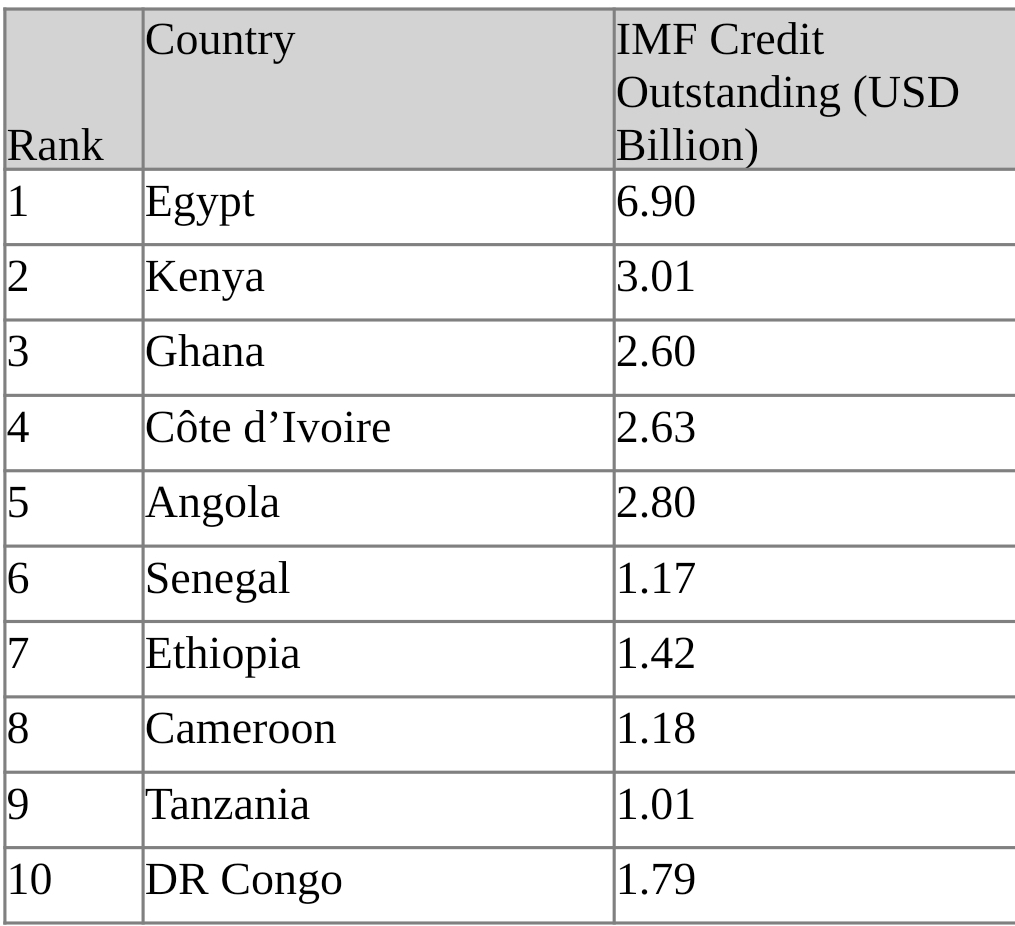

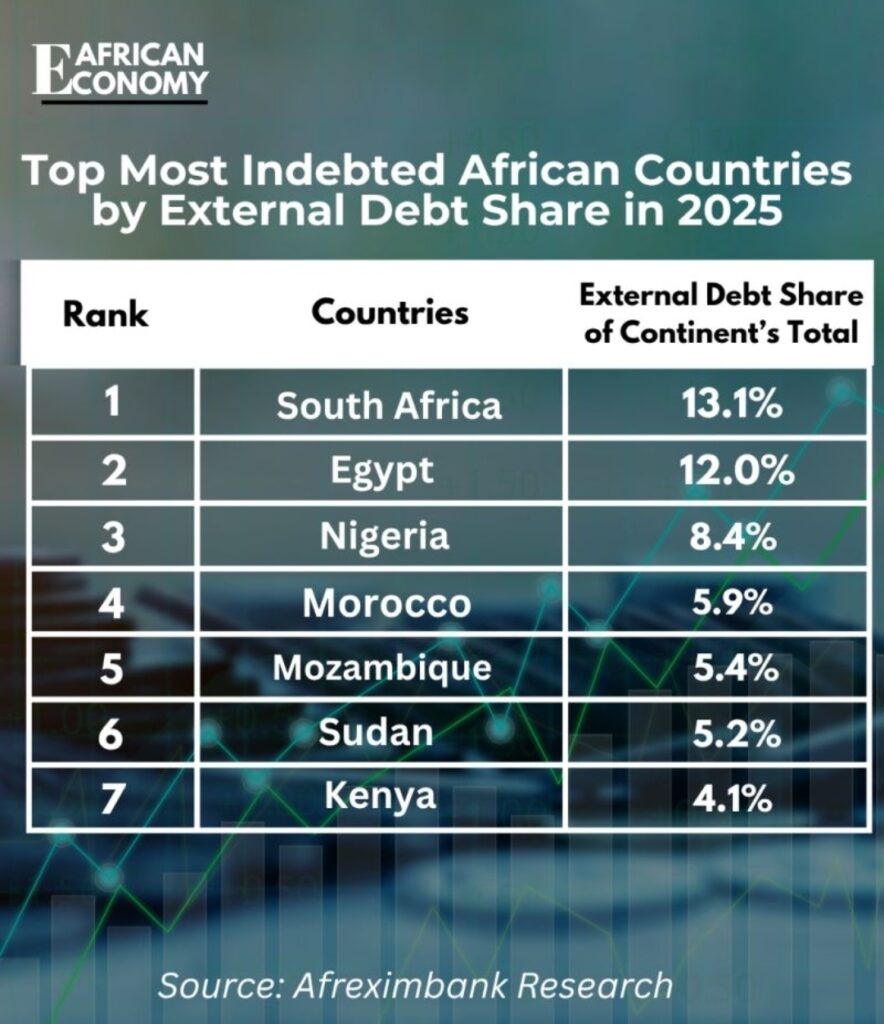

This means that many citizens continue to face poor living conditions, underfunded public programs, and limited opportunities for advancement. In countries like Ghana, Kenya, and Zambia, billions of dollars are diverted every year to repay debt, leaving very little to meet pressing domestic needs.

The presence of huge debts also slows down economic growth. When countries owe large amounts, investors view them as high risk markets. This makes it more expensive to borrow and harder to attract foreign investment.

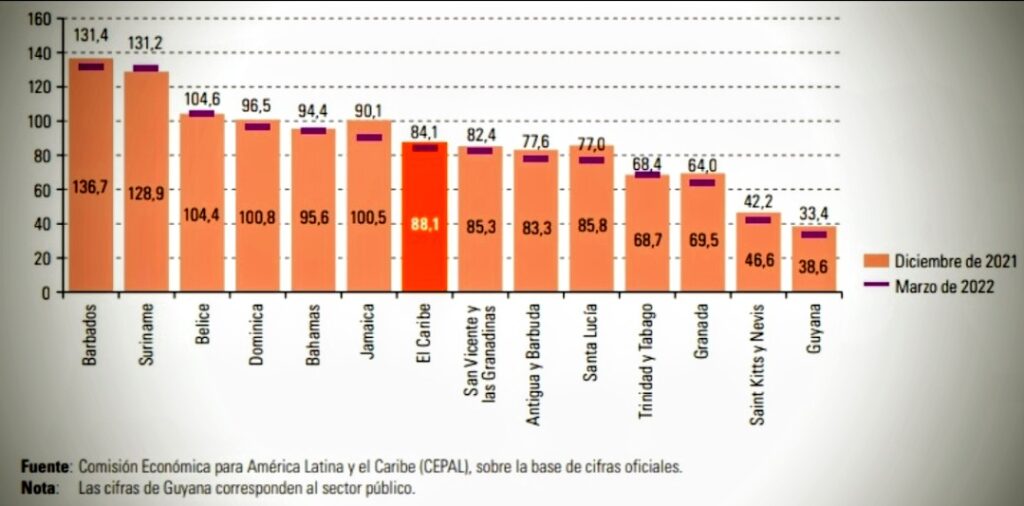

For smaller Caribbean economies such as Jamaica and Barbados, the results have been decades of austerity measures designed to meet IMF or World Bank conditions. These austerity programs often include cutting government spending, freezing wages, and increasing taxes. While these steps may help balance budgets in the short term, they also limit growth and discourage entrepreneurship, keeping many economies stagnant.

Another major concern is that foreign debt reduces economic independence. Loans from global financial institutions often come with strict policy requirements that force governments to follow foreign designed economic plans. These may include removing subsidies, selling public companies, or reducing social programs, all actions that can hurt ordinary citizens. When external institutions dictate a country’s economic path, national sovereignty is weakened, and local priorities take a back seat to international interests. This dependency leaves nations vulnerable to global market shifts and foreign political influence.

The social and political effects of heavy debt are equally damaging. As governments struggle to provide basic services, public frustration grows. Rising unemployment, poor living standards, and limited opportunities can lead to unrest, strikes, or protests. In some African countries, IMF imposed austerity has sparked street demonstrations, while in parts of the Caribbean, economic hardship has driven many young people to migrate in search of better prospects. The inability to deliver public goods erodes trust in government and weakens democratic institutions.

What makes the situation even more difficult is the recurring cycle of borrowing. When economies cannot grow fast enough to pay back existing loans, they often take new loans to cover old debts. This leads to a vicious cycle in which nations borrow to repay what they already owe, trapping them in a state of constant dependency. Over time, interest accumulates and total debt grows even larger, creating what many experts call a debt trap. In this cycle, countries remain perpetually indebted despite making regular payments for years.

However, there are growing calls for change. Many African and Caribbean leaders, economists, and civil society organizations are pushing for a fairer global financial system. Debt restructuring, relief programs, and innovative solutions such as climate linked debt swaps are now being explored. These swaps allow portions of debt to be forgiven in exchange for commitments to environmental protection or sustainable development goals. Countries like Zambia and Barbados are leading these efforts, seeking to balance economic recovery with social progress.

Foreign debt was once seen as a bridge to development, but for many African and Caribbean nations, it has become a heavy chain that hinders growth and independence.

The path forward lies in responsible borrowing, transparent governance, and fair lending practices that prioritize people over profits. Only through collective effort, both locally and globally, can these regions escape the burden of debt and move toward a future built on stability, dignity, and true economic freedom.

RELATED REPORTS

THREE AFRICAN NATIONS THAT HAVE NEVER NEEDED IMF LOANS

WORLD’S TOP 10 NATIONS MOST IN DEBT TO THE IMF