Faith Nyasuguta

Burkina Faso has officially handed over five major gold mining assets to its state-owned mining company, SOPAMIB, marking a bold advancement in the country’s drive for greater sovereignty over its natural resources. The transfer, confirmed through a decree published late Wednesday, concludes a process initiated in August 2023. It also complements sweeping reforms initiated by the junta-led government under President Ibrahim Traore following the 2022 coups.

SOPAMIB, the Societe de Participation Miniere du Burkina, was created under a 2023 revision of the mining code aimed at expanding government influence in resource management. This latest transfer brings the total number of nationalised industrial gold assets under SOPAMIB to five, including two major mines, Boungou and Wahgnion, acquired from Endeavour Mining in late 2024.

Prime Minister Jean Emmanuel Ouedraogo confirmed on national television that SOPAMIB would continue absorbing foreign-owned industrial mines. “SOPAMIB has already recovered two industrial mines, notably Boungou and Wahgnion, and this will continue,” he affirmed. The objective is clear: capture a larger share of wealth from Burkina Faso’s rich gold reserves, 57 tonnes in 2023, and channel it into national development.

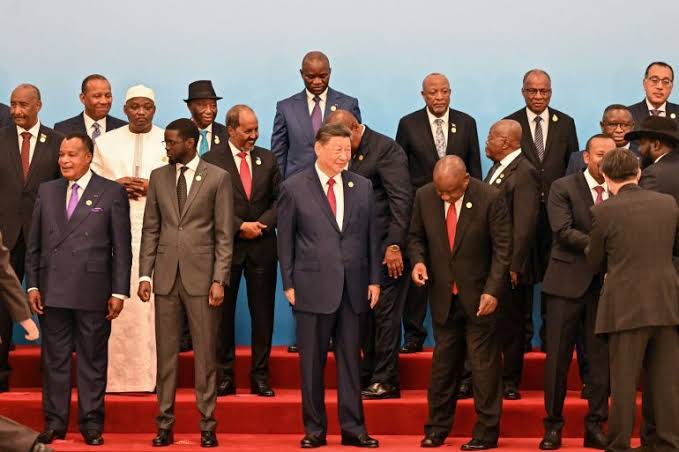

This process comes amid regional solidarity with Mali and Niger, which are also centralising control over strategic resources, distancing themselves from traditional Western partners in favor of new alliances including Russia. Burkina Faso’s pivot is illustrated by its exit from ECOWAS and the granting of a mining licence to Russian firm Nordgold in March.

Economically, the nationalisation has already delivered tangible benefits. In 2024, Burkina Faso’s National Precious Substances Company, which controls SOPAMIB, collected over 8 tonnes of gold, and in the first quarter of 2025 this soared to more than 11 tonnes. The government is also creating a national gold reserve for the first time. As Finance Minister Nacanabo noted, this sovereign gold fund will act as an economic buffer and symbol of state autonomy.

However, concerns linger among investors. Western mining firms typically supply capital, technical expertise, and export markets- elements that could vanish under heightened state control. Local analysts caution that unclear compensation terms and the speed of transfers pose risks, potentially deterring future foreign investment.

Security challenges further complicate operations. Since 2015, Burkina Faso has battled an Islamist insurgency that has disrupted infrastructure and raised operational costs for mining companies. Though production has remained robust, risk remains high and some international players have paused ventures .

Traore’s administration is betting that assertive state participation in gold mining, from mine ownership to refinery construction, will yield long-term rewards. The goal is to keep profits on home soil, invest in critical services and strengthen economic resilience.

As Burkina Faso enters this new era of resource control, a few questions linger. Will the strategy spark a national renaissance of industrial capacity and fiscal stability? Or will it deter investors and isolate the country from global markets? With five major mines now under state control, Burkina Faso’s answer will shape its economic destiny.

RELATED: