Wayne Lumbasi

Africa’s startup landscape is entering a new era defined by discipline and sustainability rather than hype.

After years of rapid expansion, 2024 marked a turning point as investors poured more than two billion dollars into African ventures but demanded something different this time – proof that innovation can truly sustain itself.

The liveliness that once fueled record-breaking funding rounds has faded, replaced by a more focused pursuit of value and profitability. Some early stars that once raised huge sums have stumbled. Companies such as Copia and Gro Intelligence, both of which attracted more than one hundred million dollars, eventually struggled under the weight of expansion and weak revenue models. Their collapse exposed the hard truth that survival now depends on strong fundamentals rather than large fundraising numbers.

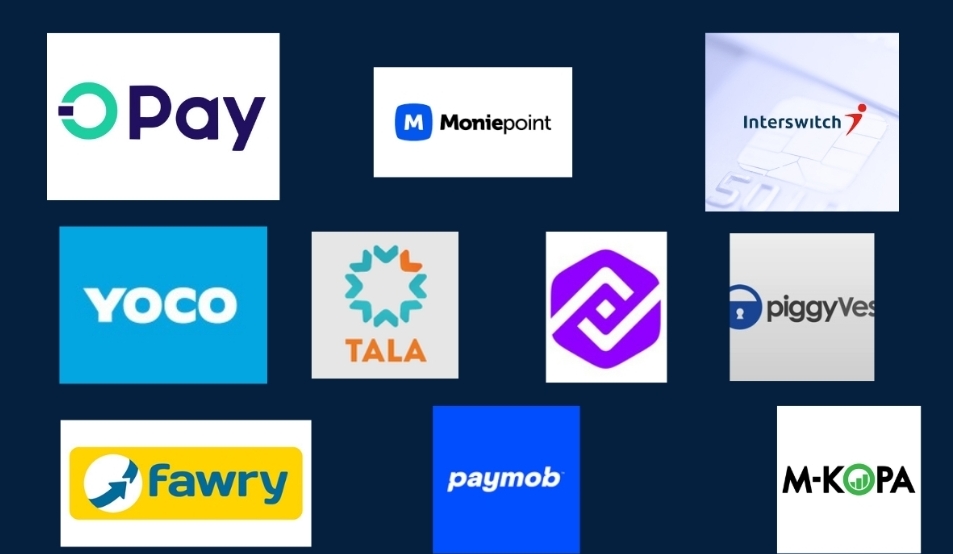

At the forefront is Flutterwave, valued at about three billion dollars. The company has built payment systems that power transactions across borders and connect local businesses to the global economy. Following closely is OPay, worth around two billion dollars, which has transformed Nigeria’s cash economy through a single digital platform that allows users to pay bills, transfer money, and access credit.

Senegal’s Wave has also made remarkable progress with an estimated value of 1.7 billion dollars. By providing affordable mobile money services across francophone Africa, it has brought financial access to millions who were previously excluded.

South Africa’s TymeBank, valued at roughly 1.5 billion dollars, continues to grow as a digital bank designed to serve low-income and underserved customers. Andela, which operates across several African countries and globally, is also valued at about 1.5 billion dollars for its role in connecting African software developers with major international employers.

Other notable players include Chipper Cash, which has simplified cross-border transfers and digital payments, and Egypt’s MNT Halan, a super app that combines lending, commerce, and payments. Interswitch, one of Nigeria’s oldest and most successful fintech companies, continues to hold a valuation around one billion dollars thanks to its pioneering role in building the continent’s payment infrastructure. Moniepoint, another fast-rising Nigerian fintech, recently joined the billion dollar club after expanding its digital banking and credit services to small businesses.

Just below the unicorn level, several fast-growing companies are quickly closing in on the billion dollar mark. PalmPay, Moove, Yassir, and Kuda have shown impressive growth through regional expansion and customer loyalty. Others such as M KOPA, Yoco, and Onafriq, formerly known as MFS Africa, continue to strengthen their presence in payments, digital lending, and consumer technology. Their rise reflects how fintech remains the heartbeat of African innovation and one of the few sectors consistently attracting global capital.

Africa’s startup story in 2025 is not one of collapse but of evolution. The continent’s tech ecosystem is becoming more strategic, more stable, and more focused on long-term success. Fintech may still dominate the billion dollar ranks, but other sectors including climate technology, logistics, and healthcare are beginning to gain momentum.

These billion dollar ventures are more than financial milestones. They represent a generation of African founders proving that world-class innovation can come from Lagos, Nairobi, Cairo, or Dakar. The new chapter of Africa’s startup revolution is not about raising the biggest round. It is about building businesses that last and reshaping how the world views African enterprise.

RELATED

25 AFRICAN STARTUPS BATTLE FOR $4M BLACK FOUNDERS FUND

GOOGLE TO BUILD FOUR AFRICAN HUBS TO IMPROVE INTERNET