Wayne Lumbasi

The International Monetary Fund (IMF) has issued a stark warning over growing debt vulnerabilities in Sub Saharan Africa, citing an alarming rise in domestic borrowing that is straining local banks and threatening financial stability. In its latest Regional Economic Outlook, the Fund noted many African governments are increasingly turning to domestic lenders to finance their budgets, often at higher costs than external borrowing.

According to the IMF, borrowing costs within the region remain exceptionally high, with underdeveloped and fragmented financial markets driving up interest rates. This shift towards domestic financing has been driven by limited access to international capital markets following recent global economic shocks, rising U.S. interest rates, and tightening external credit conditions.

However, the Fund cautioned that this reliance on local banks is creating a dangerous cycle as governments crowd out private sector credit while banks become overly exposed to sovereign debt.

The IMF noted that domestic banks’ holdings of government securities are growing faster in Sub Saharan Africa than in any other region. In some countries, these holdings now account for nearly half of total public debt. This growing exposure poses a systemic risk: if governments face repayment difficulties, it could weaken banking systems, leading to reduced lending and slower economic growth.

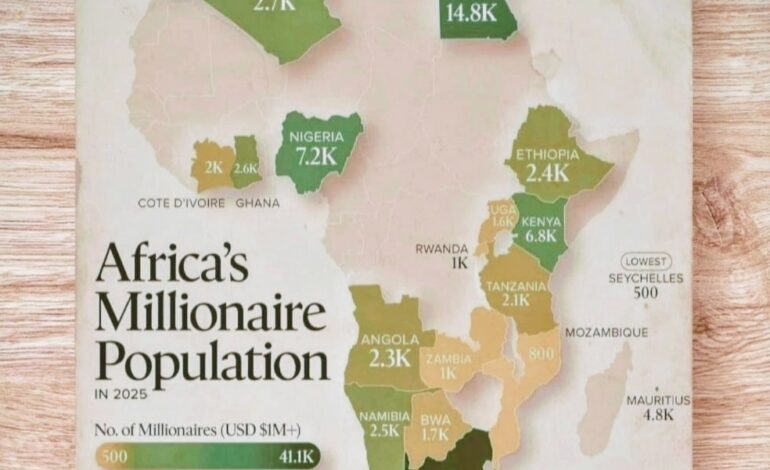

Countries such as Ghana, Kenya, and Nigeria have already faced significant fiscal pressures due to ballooning debt servicing costs. The IMF urged governments to strengthen debt management, improve transparency, and prioritize fiscal discipline to avoid falling into new debt traps. It also emphasized the need for countries to diversify revenue sources, enhance domestic resource mobilization, and attract sustainable private investment to reduce dependence on borrowing.

While some African nations are cautiously reentering international bond markets, the Fund warned that without prudent management, debt vulnerabilities could intensify. It called on policymakers to balance short term financing needs with long term economic resilience.

The IMF’s warning underscores a broader regional challenge on how to sustain growth and development amid shrinking fiscal space and rising financing costs. As concessional aid continues to decline, Sub Saharan Africa faces a critical test in ensuring that debt remains a tool for progress rather than a burden for future generations.

OTHER RELATED NEWS

IMF URGES EGYPT TO INCREASE TAXES TO SUSTAIN ECONOMIC RECOVERY

ZAMBIA’S ECONOMY GROWS THREE TIMES FASTER THAN IMF PROJECTIONS

THREE AFRICAN NATIONS THAT HAVE NEVER NEEDED IMF LOANS